Appraising

Buchanan played an important role in its transition to a public company. We not only delivered a successful IPO (the largest on AIM that year) but also gave the management team the hands-on support and guidance to move them from a family-run, private business, to a listed entity, meeting the regulatory and stakeholder obligations required.

ELEVATING

Our capital markets strategy focussed on educating a broad range of investors, sell side analysts and media on the strengths of the student accommodation market, creating interest in the story and demand for shares in the aftermarket from day one.

Whilst landing tier-1 coverage in the Financial Times, The Times, Daily Telegraph and Evening Standard, Buchanan was also able to use our relationships with the FT to create widely accessible digital content – a short Lex video featuring Jonathan Ely, Lex writer and Oliver Ralph, Deputy Head of Lex at the time – that discussed the prospects of UK student market and found an international audience.

As Watkin Jones moved into new operational areas, Buchanan’s support evolved alongside it, successfully positioning the company as a market leader as they developed their ‘Build to Rent’ and ‘Affordable Housing’ assets whilst dealing with a changing management team and Board.

We expanded our advisory to integrated ESG communications, placing the Company on the radar of larger investment banks and helping them to achieve the Best European ESG Materiality Reporting Award in 2022.

AMPLIFYING

By being creative and dynamic with our advice and support we have made the most of the tangible markets Watkin Jones operates in, regularly taking investors, analysts and media to visit sites and see for themselves how projects are evolving.

This approach has helped build a broad range of interested and loyal stakeholders who support the Company through the inevitable challenges it faces. For example, in September 2022 as both the UK economy and public markets hit one of the worst periods of volatility and uncertainty since 2008, Watkin Jones was forced to acknowledge that interest rate rises would impact financial performance.

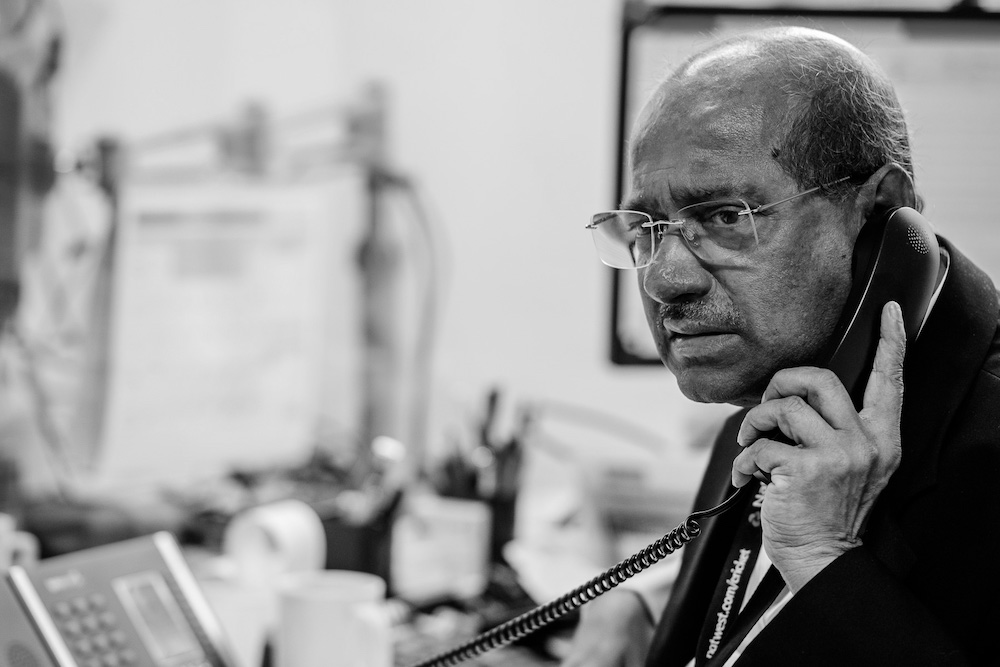

When the Company issued a trading statement to update the market, the CEO and CFO were able to leverage these carefully cultivated relationships with key analysts and journalists to ensure balanced coverage and an appreciation of longer-term growth prospects.

As the market recovers, these connections and underlying fundamentals of the investment case will help support a rebuilding of the valuation.