Appraising

Driven by growing societal expectation of positive action, Oil & Gas companies find themselves under constant scrutiny to overhaul decarbonisation strategies.

When Lucid Energy, a privately owned American midstream gas processing operator, set out to create its maiden Sustainability Report for its stakeholders, this missing internal expertise was precisely the barrier its leadership faced.

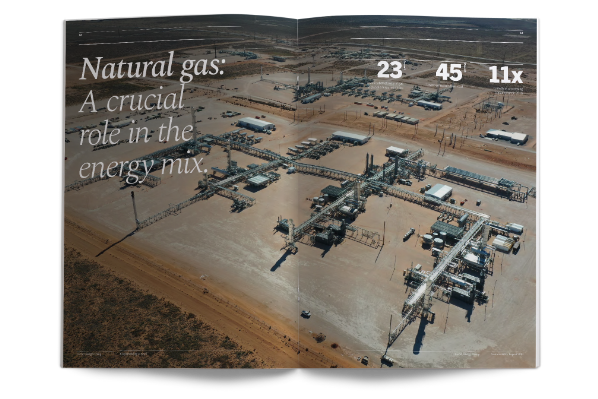

A premier midstream Oil & Gas operator in New Mexico, Lucid’s operations enabled its upstream customers to commercialise the prolific Permian Basin.

Encouraged by its private equity sponsors, Lucid’s executive management team and board seized the opportunity to capture and articulate the company’s ESG credentials to meet growing stakeholder expectation.

To do it, the Lucid team understood it required support from a highly creative partner that had a proven track record and expertise in successfully telling the ESG story in a way that would resonate with stakeholders, while also adding weight to the company’s value proposition.

They chose us to be that trusted partner.

ELEVATING

The first benefit of working in partnership on their ESG strategy would be that Lucid’s management team was suddenly able to properly understand the company’s baseline knowledge of ESG matters and disclosure requirements.

It was a key moment in the journey, immediately creating a secondary benefit in allowing the Lucid team to set a context within which it could explore and define how it wanted its overarching ESG and Group strategies to evolve.

Lucid discovered another critical benefit through this collaboration too.

As work progressed, a process of internal engagement began to evolve that allowed Lucid’s leadership to identify and then engage and collaborate with in-house subject experts to create a compelling narrative that mapped the entire content needed for their maiden sustainability report.

AMPLIFYING

The market-leading ESG publication that followed captured all the company’s ESG-related activities in alignment with SASB and IPIECA Reporting Standards, ensuring that when measured against the same benchmarks, Lucid compared favourably to its peers.

The release of the report also coincided with confirmation from the US Environmental Protection Agency that it would approve Lucid’s pilot carbon capture facility to accommodate increased interest and scrutiny from the market.

Not long afterward, Lucid announced the sale of its business to Targa Resources, a larger mid-stream processing operator. This acquisition was completed on July 29 2022, achieving a satisfactory exit for the company’s equity owners.

Following completion of the maiden Sustainability Report, we were retained by Lucid for ESG advisory services, including sustainability strategy definition and all content development for reporting purposes.

We were also commissioned for the design and production of Lucid’s Responsible Business Report.