ESG advisory

Brand development

Annual report advisory

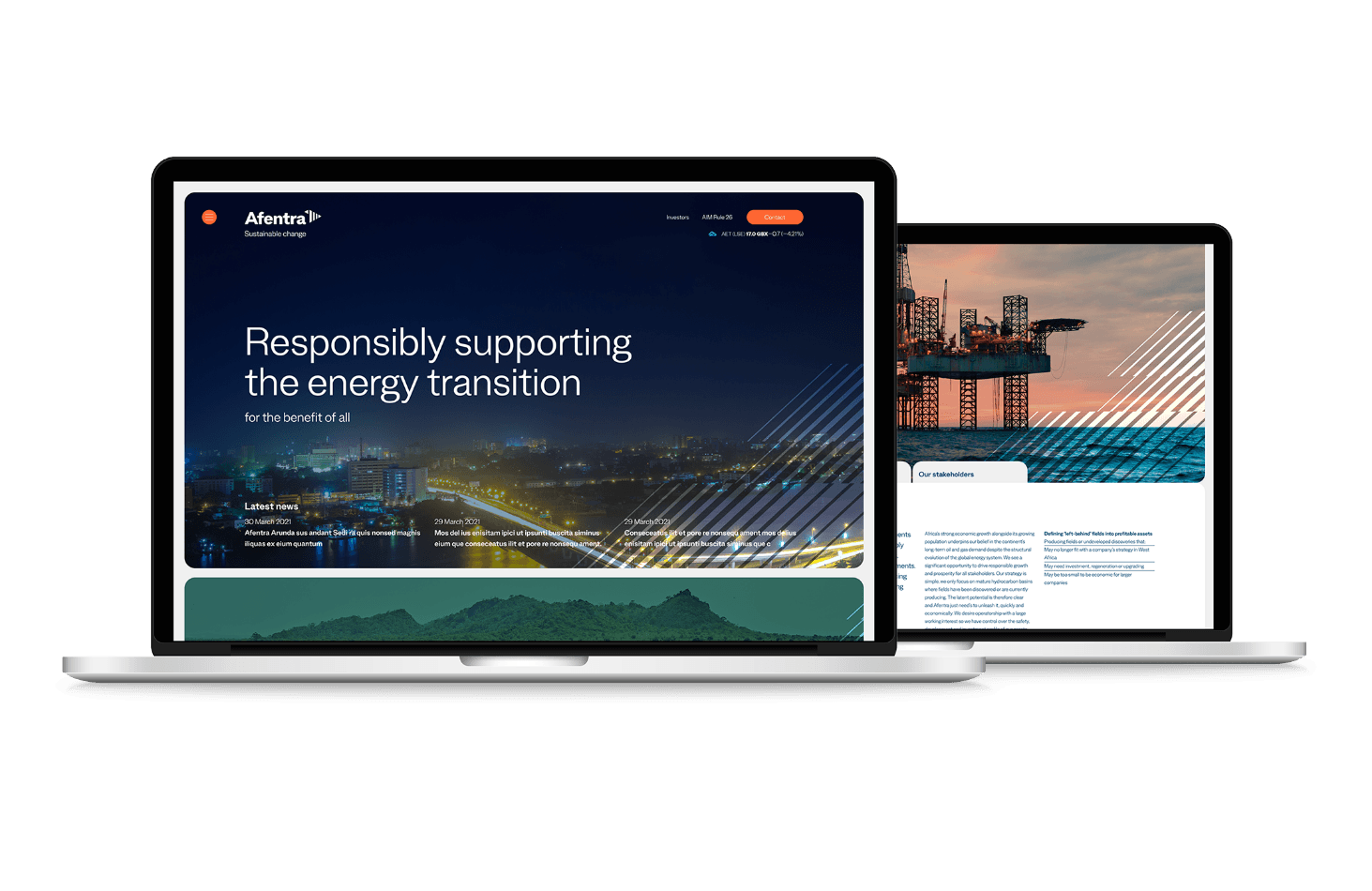

Website communications

Appraising

With major operators moving towards renewable energy and away from hydrocarbons, the new team wanted to fill that space with an operator that had sustainable development and shared value creation at the heart of its proposition.

The challenge with the current company was that it was effectively a cash shell, so the re-launch of the business needed to centre around the transition thesis and associated strategy.

Buchanan was tasked with a full re-positioning of the business, including the definition of a revised investment narrative, creation of a new identity that was fit for purpose and the development of an effective communications programme.

Buchanan conducted an initial workshop to explore the company’s evolving proposition and sought to capture this in a clearly identifiable way. This included:

- Re-naming of the business and creation of a new brand identity to reflect their sustainable strategy and a responsible African energy transition

- Ensuring that ESG themes were at the heart of that proposition

- Build and delivery of a new corporate website and investor presentation

- Generation of positive media coverage of the re-launch

Given the timescales necessary to complete the deal, this programme was completed within an accelerated 8-week timetable.

ELEVATING

Buchanan crafted a bold new narrative that focused on the requirement to see a responsible and just energy transition for Africa. These embedded themes stimulated a pragmatic debate around these critical aspects of climate change, and enabled Afentra a degree of ownership around the energy transition topic.

An authentic ESG culture underpinned the foundations of the company launch, recognising what a critical component this would be in fulfilling the company’s growth objectives in the face of challenging headwinds for growth E&Ps seeking to access capital.

AMPLIFYING

Buchanan marshalled the successful re-launch of the business under its new strategy and identity, securing a high-profile article in the Financial Times – which was significant for a little known £40m company.

This was supported by an impactful corporate presentation that provided a high-level overview of the specific market dynamics – a particular challenge given that the company at re-launch was an investment concept, with no physical assets to build this transition story around.

Buchanan’s ability to serve as a single source of specialist communications skillsets that included brand, ESG, digital and financial communications was a key differentiator in our appointment, especially given the launch deadline which was a mere 8 weeks from appointment.

Paul McDade, Chief Executive Officer, Afentra plc

In the period following re-launch, Afentra has announced inaugural transactions through two deals in Angola that see the company underpinned by reserves, resilient production and steady cash flow.

Buchanan continues to generate supportive media coverage that positions Afentra as a responsible operator capable of capitalising on the unique sector trends and supports ongoing corporate disclosures through reporting and digital channels.

Buchanan has helped establish and grow the profile of Afentra amongst its target stakeholder audiences – that includes industry IOCs/NOCs, African governments, investors, lenders, regional/international media and UK capital markets – to support the company’s long-term growth ambitions.